If you’re preparing for the ACCA TX (UK) exam—whether you’re based in the UK or abroad—you’re in the right place. This guide walks you through what the UK variant is all about, what to expect on exam day, and how to prepare effectively. It’s designed to give you clarity and confidence, especially if you’re not quite sure where to start.

The ACCA TX paper—short for Taxation—is all about understanding and applying tax principles. The UK variant focuses entirely on UK tax laws. You’ll need to get to grips with:

Whether you’re a UK resident or an international student working towards UK-based clients, this variant is essential for mastering real-world tax scenarios.

The ACCA TX (UK) variant is popular both among local and international candidates. If your future work involves UK clients, global firms, or you’re planning to settle in the UK, then this is your best choice. ACCA allows you to choose from a few regional variants, but the UK one is the most commonly taken—and arguably the most useful.

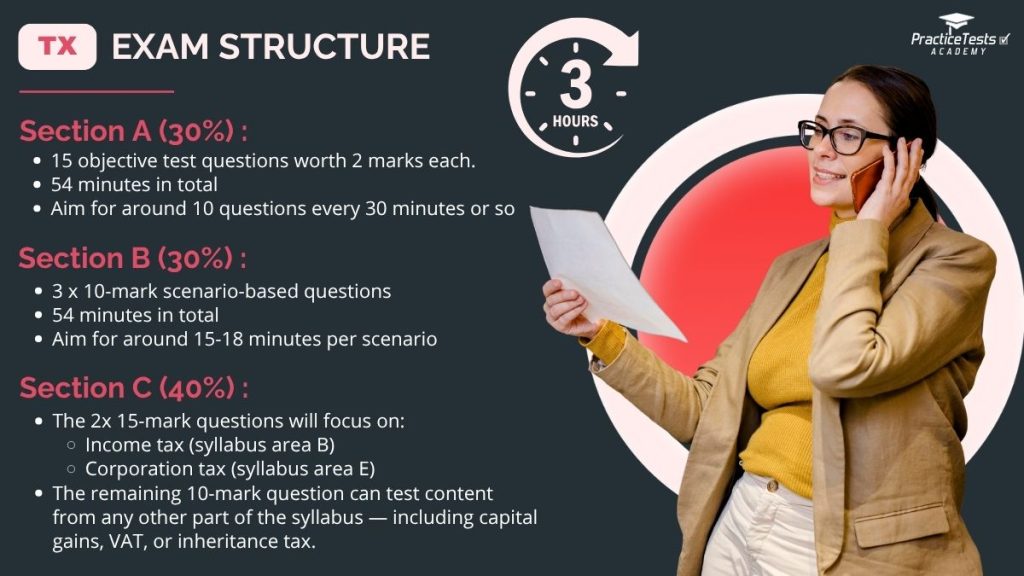

The ACCA TX UK paper is a computer-based exam that lasts 3 hours. It’s divided into three sections:

Each section tests not only your knowledge but also your ability to apply it logically and quickly under timed conditions. It’s important to practise each type of question format separately and then integrate them in mock conditions.

Expect to cover a lot of ground:

It’s broad and detailed. You’re not just memorising rates; you’re understanding how to apply rules to real-world situations. For example, you may be asked to compare tax implications between employment and self-employment or calculate the tax due for a non-resident company with UK-based operations.

👉 View the full official ACCA TX UK syllabus here.

Let’s be honest—ACCA TX UK isn’t easy. Many students trip up on:

Other challenges include skipping topics they find difficult or spending too much time on reading theory without applying it. The ACCA TX UK exam rewards practice, not passive reading.

You cannot succeed in the ACCA TX UK exam without memorising the basics. This includes knowing current:

Use flashcards, quick reference sheets, or summary tables. Repetition is key.

Understanding rules is one thing—applying them under timed conditions is another. Practise:

Start slow, then build up to timed mocks. Treat your preparation like training for a race.

The calculation elements can be complex and multi-layered. Make sure you:

Use PTA’s question banks or spreadsheets to improve your computational speed.

After every practice session, consult ACCA marking guides. These show exactly how marks are awarded and how little phrases can make a difference between scoring 1 mark or none. For example:

This insight helps you tailor your exam technique.

It’s tempting to keep practising what you already know, but growth lies in struggle. Identify your weak topics—be it capital allowances, VAT reverse charges, or residence—and set a revision sprint around them. Our platform allows you to filter questions by topic.

Don’t just read—test yourself. Try:

The more you retrieve and use information, the more it sticks.

At Practice Tests Academy, we’ve built resources specifically for the ACCA TX UK exam. Our practice kits include:

These help you go from understanding theory to actually passing the exam. You can practise by topic, difficulty level, or simulate full exam conditions.

Our ACCA TX UK video courses are designed for visual learners. We break down the syllabus into bite-sized lessons led by experienced tutors who explain:

It’s a more engaging way to learn and a great way to supplement your written notes.

Final checks matter:

Also, make sure you’re familiar with the exam format and flagging questions to revisit. Small things reduce stress and improve your performance.

The ACCA TX UK exam is challenging but absolutely doable with the right tools and mindset. Thousands have passed before you—now it’s your turn. Believe in consistent effort, not last-minute cramming.

Not sure where to start? Try our free package—no commitment. It includes questions, answers, and tips to get you going. It’s a great way to test your current level and see where to focus.

Choose your path to success with ACCA TX-UK. Try our free package or upgrade to a premium plan for expert support and resources.

Sign up for our weekly newsletter to receive expert guidance, study resources, career tips, the latest discounts, and more.